Signs of life in the small cap market

Published 24-FEB-2024 10:00 A.M.

|

8 minute read

Did anyone notice it?

It was almost imperceptible...

But it was there.

Over the last 8 or so trading days, tiny signs of life are starting to emerge in the small cap market.

Over the last few months, the small cap market has been the worst we have seen in years.

Most small caps are trading at 12 month lows.

Many at near all time lows.

There is almost zero liquidity (daily trading volumes).

Any price rise from good news released is quickly snuffed out as stale shareholders use the liquidity to exit positions.

Most likely not because there is anything fundamentally wrong with the company - the sellers literally just need the cash for life expenses, or to participate in an attractive cap raise somewhere else.

And then there are the desperate cap raisings from companies unfortunate enough to have run out of money, coming at steep discounts and with free options to entice new investors to part with cash.

BUT...

In this week's trading sessions, we noticed many long ignored stocks in our portfolio and on our watchlist were seeing little nibbles of buying.

A few small but green days in a row.

And more importantly, the little price rises were NOT instantly met with selling.

Have most of the sellers now finished?

Are the first cohort of risk takers re-entering?

It’s way too early to tell.

We also saw two capital raisings this week that did NOT include free attaching options (MNB and GUE)...

A very rare and positive sign in such a low sentiment market for small caps.

While it's only a week of trading and the signs are tiny, it's a nice reminder that small cap markets can and do eventually turn back positive.

It's a different story at the big end of town, however.

Wall Street is calling it a “Bull Market” with the DOW hitting an all time high this week and the NASDAQ within striking distance of its all time high.

Japanese markets hit an all time high, after languishing for decades.

In Australia, the ASX 200 (basket of the 200 biggest ASX listed stocks) hit all time highs too in recent weeks.

But for those of us that play in small cap land, the sentiment hasn’t turned... yet.

A big factor that drives risk-on appetite in small caps is how “rich” people feel at any given time.

This can be impacted by low interest rates OR seeing some wins on your portfolio of large cap stocks.

Hopefully the positivity at the bigger end of the market will start trickling down to small caps in the next few weeks.

A key inflection point that occurred at the big end of town this week was Nvidia’s results being announced.

There were sky high expectations, and Nvidia beat them.

Single handedly pouring fuel on the positive sentiment in the market.

Nvidia almost hit a $2 trillion market cap to become the third most valuable US-listed company.

(Source)

This happened on the back of better than expected earnings as the tech infrastructure giant continues to ride the AI wave.

When massive amounts of capital is generated from a large cap company it is a good signal to the market of a bullish return.

Investors leveraged to Nvidia feel wealthier and are willing to take bigger risks with excess capital.

Another development that caught our attention this week was the UAE critical minerals and free trade agreement with Australia:

(Source)

Australia has a long history of success when it comes to mining.

And the UAE is looking to strengthen its supply chain of critical minerals relevant to the energy transition.

(and they have bottomless pits of money... enough to collect retired soccer superstars as a hobby, and basically buy the entire sport of golf.)

There have been some question marks over the longevity of battery metals projects in Australia, with lithium and nickel production projects being squeezed.

However, this trade agreement signals that the long term demand picture is strong - and the UAE will be in a position to cut big cheques to guarantee mineral supply.

This looks to be a good sign for our battery metals exploration and development stocks, as the interest for countries to secure supply chains remains strong.

And breaking news on the metals supply side...

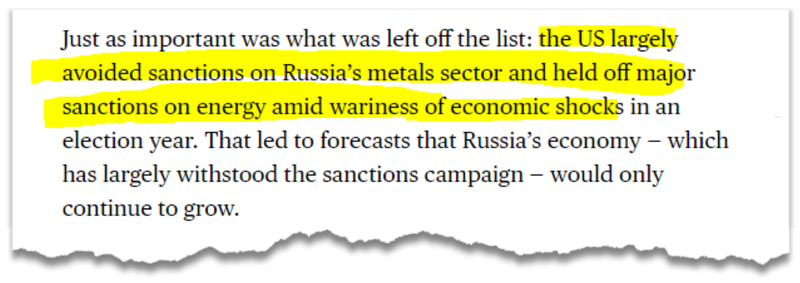

Last night we saw the US slap a whole new bunch of sanctions on Russia in response to the Ukraine war and death of the Russian opposition leader.

(Source)

Interestingly, the new sanctions avoided metals and energy, a clear signal of where the weak point that needs to be plugged with local supply or supply from friendly countries:

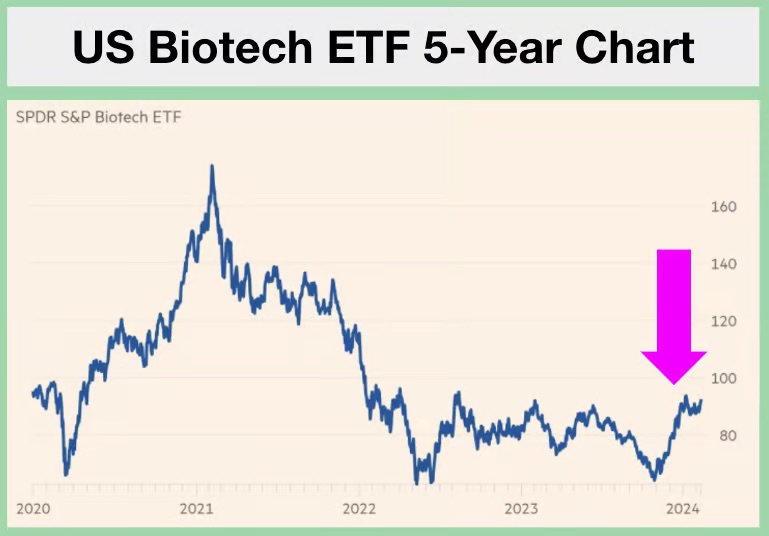

One area of the market that has been strong for four months now is the Biotech Sector.

With the Biotech S&P ETF up 40% since last October:

US$6.2BN in equity was raised by biotech companies in January, the highest amount in 3 years.

Our Finifeed Biotech Portfolio has delivered our strongest returns in 2024, with key performers Arovella Therapeutics (ASX:ALA) and Neurotech (ASX:NTI) both hitting investment high points this week.

With these small shoots emerging across the markets, we think that the small cap market could return to normal sooner rather than later.

And then hopefully into bull market territory for a couple of years.

On that note, we wanted to highlight today a number of companies in our Portfolios that have imminent share price catalysts.

As investors in the small cap end of the market, these catalysts are what we invest for, and any of these results could be company making.

(but on the flipside, if the results don’t meet or exceed market expectations, the share price could fall)

Things to watch out for in the coming weeks

Here are some companies across our portfolio that we are expecting material news from in the next couple of months.

Clinical Trial Results

Clinical trials are the backbone of any early-stage biotech company. They provide necessary evidence that a drug is safe and effective before it can be sold to the market.

The results can take multiple years and millions of dollars - a positive outcome can be game changing for a company.

Here are the imminent clinical trial results we are looking out for:

- NTI: Results from a Phase II/III trial for Autism Spectrum Disorder (April)

- NTI: Phase I/II Rett Syndrome clinical trial (positive Rett Syndrome results laid the foundation for Neuren Pharmaceuticals now +2,000% re-rate) (March).

- DXB: Interim results from its Phase 3 clinical trial on FSGS (March). DXB already has a US$230M+ commercial deal signed for EU/UK, Canada and Australia.

- ALA: ALA should soon publish data on animal studies from the ALA + Imugene partnership for solid tumours (Q1 CY2024).

Want to learn more? Read: How we invest in early stage biotech companies

Oil & Gas Flow Test Results

Once a company discovers oil or gas they will need to conduct a “flow test” to see how much of that resource they can extract from the ground.

These flow tests are important for companies, as they highlight whether or not a resource is commercial.

Here are the companies in our portfolio with upcoming flow tests:

- 88E: Flow test of its Hickory-1 oil & gas discovery in the North Slope of Alaska in the US (March).

- EXR: Flow test of its appraisal gas well in Queensland where conventional gas was discovered (April).

- IVZ: Flow test of its hydrocarbon discovery in Zimbabwe (medium term)

- NHE: Flow test of its helium discovery in Tanzania (medium term)

Drilling Results

Mining companies in the “exploration” or “definition” phase will undertake drilling programs to either make a new discovery or increase the size of their deposit.

Drilling results are reported to the market by the company and can move share prices up OR down depending on whether they exceed market expectations or break market expectations.

Each new drilling program presents an opportunity to beat market expectations and for the company’s share price to move up on a positive result.

Here are the companies with drilling results imminent:

- HAR - Assay results from its uranium project in Senegal.

- TYX - Assay results from its Angolan lithium project. TYX has hit plenty of visual spodumene in its drill cores so the assay results should be interesting.

- BPM - Assay results from its gold drilling program in WA next to $1.6BN Capricorn Metals (March/April).

Want to learn more? Read: A beginners guide to drilling results

Drilling to Commence

Commencing a drilling program can also be a catalyst for a company, as it signals that material results will be published soon.

Here are the companies set to commence drilling soon:

- TG1: The company is set to commence drilling on its Ida Valley Lithium program in the next few weeks.

- PUR: Set to commence drilling for lithium brine in Argentina.

- GUE: This week GUE raised $6.1M, enough to fund multiple uranium drilling programs for its various North American projects (Mid-Year).

Uranium eBook

Today we are publishing our uranium ebook, where we deep dive into what has happened in the uranium market:

What we wrote about this week 🧬 🦉 🏹

Elixir Energy (ASX: EXR)

This week EXR upgraded its prospective resource by ~3x to 3.6 trillion cubic feet, at its gas project in Queensland. Flow testing is set for April.

Read: 🛢️ Upcoming Price Catalyst: EXR flow test in April

Neurotech International (ASX:NTI)

The supplier of the only currently approved Rett Syndrome treatment (a $6.3BN US company forecasting to make up to ~US$800M/year from treating Retts) was subject to a short seller report...

We give our take on the short report as well as what it means for our own development stage biotech looking to treat Rett Syndrome (amongst other neurological conditions).

Quick Takes 🗣️

88E flow test is now just weeks away

88E gets first 20% of its Namibian project

EXR prospective gas resource increases to 3.6Tcf

GLV picks second target for seismic reprocessing

GTR on track to drill for uranium in Q3 2024

HAR restarts RC drilling at its uranium project

IVZ recognised as 2nd largest discovery in Sub Saharan Africa

NTI update on PANDAS/PANS clinical trial

TG1 February exploration update

Bite sized summaries of the latest mainstream news in battery metals, biotechs, uranium etc: The Future Money: https://future-money.co/

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.